News and Articles

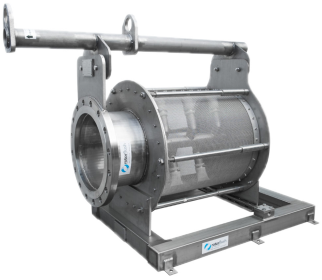

Small Self-cleaning Filters 30-90 litres / minute

A range of small self-cleaning filters suitable for domestic and light industrial use.

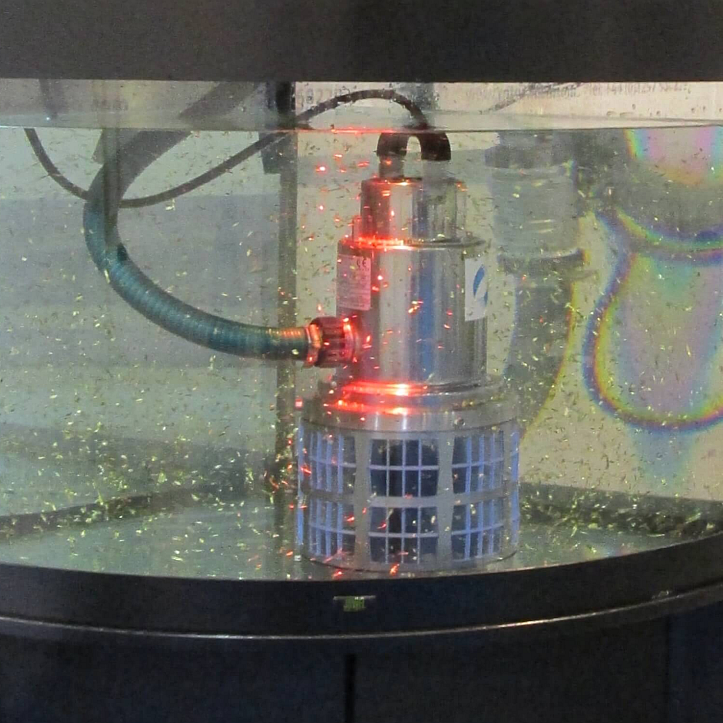

Submersible Filterpumps with Self-cleaning Intakes

Rotorflush Filters Ltd manufacture and supply submersible filterpumps with self-cleaning intake screens. The intakes to our pumps have an automatic and continuous backwash that prevents debris from clogging the pump.

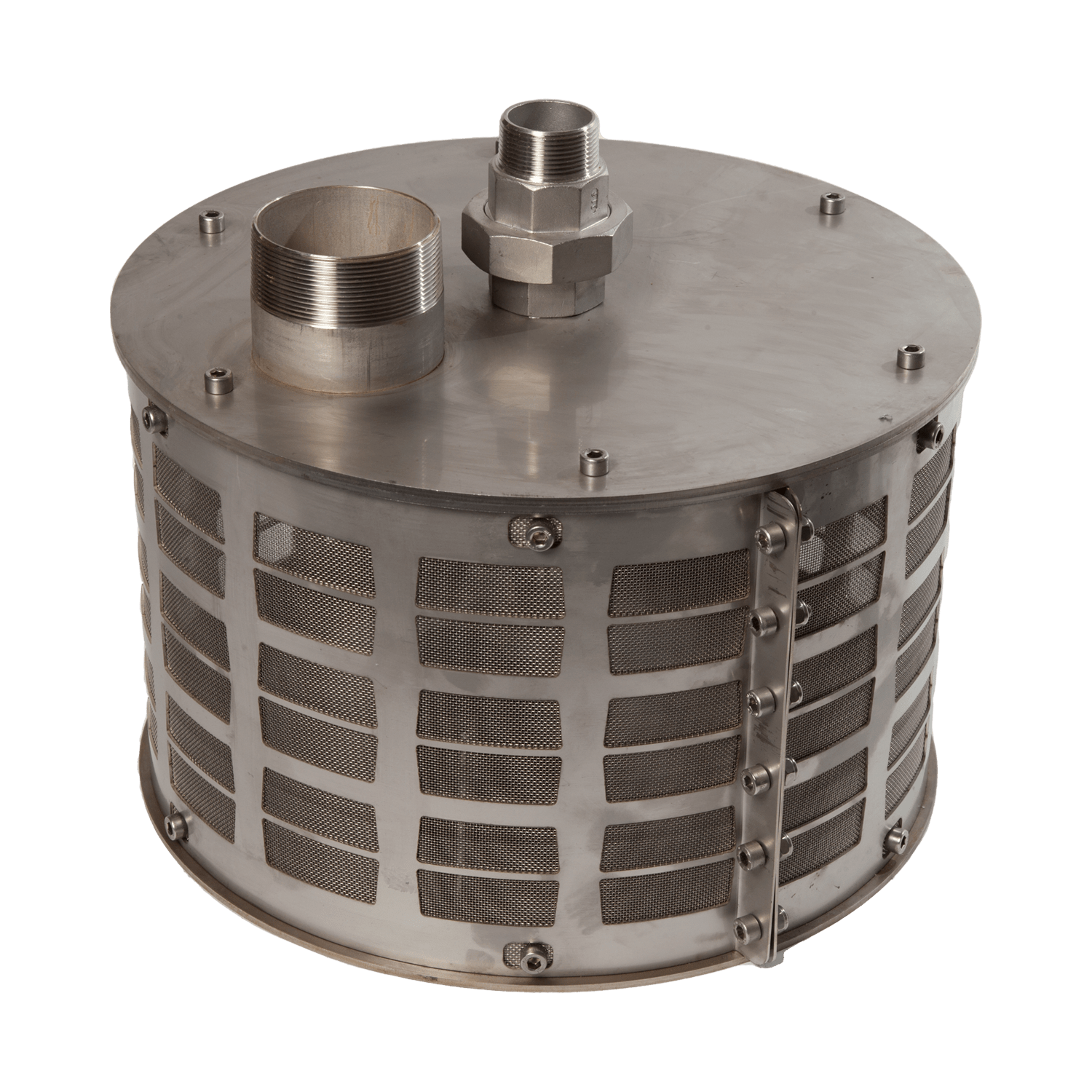

Self-Cleaning Suction Intake Filters & Strainers

Rotorflush Self-Cleaning Suction Intake Filters & Strainers are for use with surface mounted pumps.

Self-cleaning Analyser Filters

Filtration for sample water supplying online instruments & analysers monitoring water, wastewater, and final effluent quality.

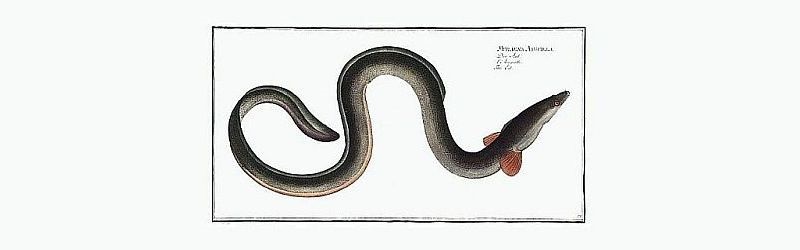

Eel Screening Intake Strainers

Rotorflush Self-cleaning Eel Screens and Eel Screening Intake Strainers are designed for use on the suction hose of surface mounted pumps. They can also be used as gravity fed intakes as long as a pump is used to supply the backwash.

How Rotorflush Self-Cleaning Filters Work

It is no mystery how Rotorflush self-cleaning filters work. The same self-cleaning mechanism keeps the filter mesh clear on all our products.

This website uses cookies to ensure you get the best experience. Learn more